“Money makes money. And the money that makes money, makes more money.” Benjamin Franklin

This centuries old quote by our founding father could not be more appropriate today. Millions of Americans are out of work, surviving on government subsidies and yet the stock market and real estate market are approaching historic highs. Those with capital and a willingness to invest will profit from the shift just like they have in the past.

This is Quinn’s fourth economic shift during his career – the bank failures of the early 90’s, the tech bubble of ’00s, the financial crisis of ‘08 and now an inevitable COVID-19 induced downturn on the horizon. In each case there were winners and losers. Those clients who could weather the storm, identify opportunities and take calculated risks created significant wealth in each shift.

For those wealthy clients, the question turns to how to keep the capital they have accumulated working and transfer it to the next generation. It is here that problems arise. The opportunities that created the current wealth may never arise again – just ask the owners of coal mills, newspapers and, most recently, video rental stores. Second, the next generation may not be adept at or have the desire to manage the wealth. Third, the wealth is controlled by those who are unwilling to take further risks, thereby stunting future growth and missed opportunities.

To help counsel clients on how to overcome these problems, we created a few do’s and don’ts:

- Do fund education, whether it is college, trade school or graduate degrees. Even if the education is not fully utilized during the heir’s lifetime, the social connections and peers they meet will stay with them forever.

- Don’t overlay your goals and objectives on your heirs. It is their life, let them fail, however hard it is.

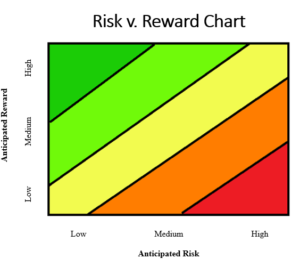

- Do talk with your heirs about being proper custodians of wealth. This includes spending within income means and investing capital wisely. Wisely in this instance does not mean without risk. Take the following risk reward chart. Wise investors are not looking for the low risk high reward unicorns in the top left green corner, but are adept at avoiding the low reward high risk area in red. Wise investors stay within the light green and yellow bands.

- Don’t make annual or more frequent gifts of cash or other liquid assets. This money usually gets used to supplement the recipient’s lifestyle and rarely gets invested. It also creates an expectation that is not easily turned off if you are unable to continue the gifts.

- Do solicit investment ideas from your heirs. This creates a collaborative environment where opportunities are presented, evaluated and decided upon. Subtly teaching skills the next generation can build upon.

- Don’t simply write checks to your heirs expecting that they will repay you. Properly document the transfers as loans or investments. Secure loans with liens on assets purchased and make sure all supporting documentation is completed, signed and preserved. Creating the expectation of a return on your investment or repayment of the loan adds a level of urgency to the opportunity.

- Do assist heirs with down payments on their first home or business opportunity IF the heir can reasonably afford the remaining loan. If the heir has insufficient income to support themself and service the debt, suggest alternatives that are more realistic, or you will find yourself having to pay for emergencies and service the debt in the future as well.

- Don’t continue to fund a poorly performing investment. Better to allow the opportunity to fail, and then invest in getting the heir back on their feet or an alternative opportunity.

- Do allow your heirs to realize the gains from opportunities they identify, especially if your estate will be subject to estate taxes. This can be accomplished by lending money at extremely low interest rates (the mid-term (3 to 9 years) AFR is currently .41%), thus making it easier for the heir to service the debt and retain any appreciation.

Providing capital can be gratifying and financially rewarding if done correctly. If not done correctly, it can turn into a financial disaster for you and your heirs. Hopefully, you can implement a few of these do’s and don’ts into your estate plan. Of course, if you want to discuss a particular issue, please give us a call.